At the 2026 World Economic Forum in Davos, U.S. President Donald Trump delivered a series of remarks that have sent investors and traders into “bullish” mode, sparking optimism across crypto markets, stock indices, and broader financial sentiment. Traders interpreted three key signals from Trump’s address as potential catalysts for accelerated growth — especially in digital assets and U.S. equities.

Whether you’re an investor, crypto trader, or everyday saver, understanding these bullish cues can help shape your strategy for 2026 and beyond.

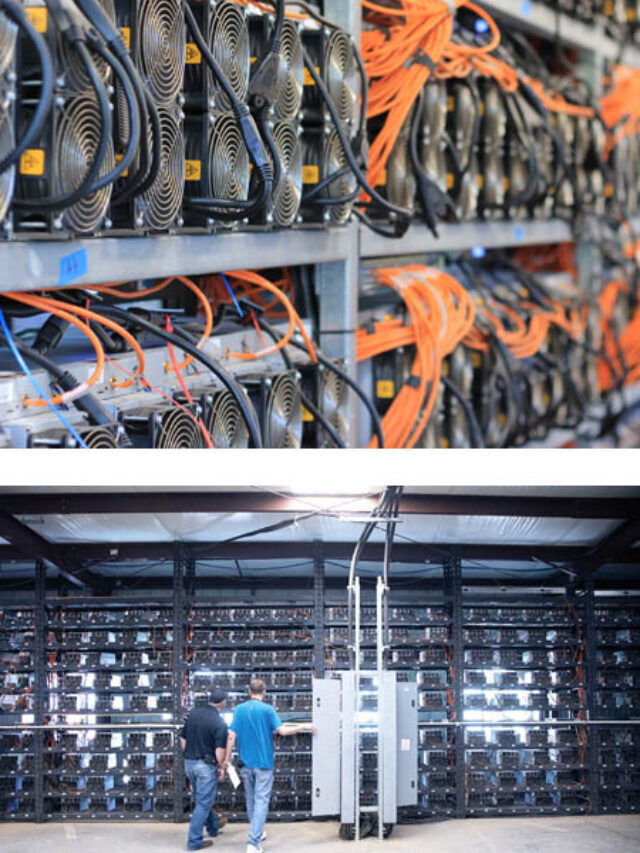

Trump’s Bold Crypto Stance Sends Ripples Through Digital Markets

One of the most talked-about takeaways from Trump’s Davos speech was his explicit support for making the United States the “crypto capital of the world.” He emphasized regulatory clarity and legislative action that would encourage growth and innovation in digital assets — a message that traders took as a strong positive signal.

“I’m also working to ensure America remains the crypto capital of the world,” Trump said, highlighting ongoing efforts to shape U.S. crypto policy.

This kind of affirmation helped lift some risk assets and boosted sentiment among traders betting on digital currencies like Bitcoin and Ethereum, which often react not just to economic fundamentals but to shifts in regulatory outlook and investor confidence.

Optimistic Outlook for U.S. Stocks Helps Calm Volatility

Beyond crypto, Trump touched on broader economic themes that resonated with stock market participants. He projected confidence in long-term gains for U.S. equities, downplaying short-term volatility and emphasizing potential upside in major indexes.

While not all investors fully echoed his optimism, this message contributed to a risk-on sentiment among traders — particularly in sectors sensitive to economic growth expectations like technology and industrials.

This bullish view on stocks comes at a time when broader market sentiment can swing rapidly based on economic data, central bank policy expectations, and global trade developments.

Read More : US Chip Tariffs Explained: Why South Korea Isn’t Worried—Yet

Policy Clarity Boosts Economic Confidence

Another key takeaway was Trump’s pledge about legislative progress, including the acceleration of work on financial market structure and related frameworks. Markets tend to favor clarity and predictability in policy direction, and Trump’s vow to work with Congress on areas like market structure signaled to many traders a reduction in regulatory uncertainty.

This is particularly relevant for investors in sectors where policy shifts can have major effects — like banking, financial services, and technology.

The comments were delivered during discussions at the World Economic Forum, where global leaders and investors closely monitor economic and market signals.

What This Means for Investors in 2026

Stocks

Bullish messaging from a sitting U.S. president can affect sentiment, especially on major indexes like the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. Recent moves off tariff concerns and macroeconomic fears suggest markets are sensitive to policy optimism.

Crypto

President Trump’s comments about strengthening crypto’s position in the U.S. helped calm some fears around regulation — an area that has historically created major volatility in digital assets. Whether this converts into sustained price increases depends on legislative follow-through.

Broader Economy

While bullish signals can lift sentiment, underlying economic risks — such as tariff disputes, inflation concerns, and geopolitical uncertainty — still matter. Investors should balance optimism with fundamentals and risk management.

The Bottom Line

Donald Trump’s remarks at Davos weren’t just political sound bites — they were interpreted by financial markets as three separate bullish signals pointing toward a potentially stronger risk asset environment. From crypto optimism to stock market confidence and policy clarity, these cues could shape investment trends throughout 2026.

But it’s important to remember — market optimism doesn’t replace economic fundamentals. Savvy investors will watch how these policy directions play out in legislation, corporate earnings, and global economic data in the months ahead.

Written by FinanceBeliever Editorial Team

Covering U.S. markets, policy, and investment trends.