For years, I fell for the same cycle.

A new crypto would trend on X.

Influencers would say it’s “early.”

Charts would look perfect.

And I’d think, this one feels different.

By 2026, I finally accepted something uncomfortable:

most people don’t lose money in crypto because they pick bad projects — they lose money because they chase narratives too late.

This isn’t a list of coins that will “explode.”

It’s something more useful: how I now spot crypto narratives before they flood timelines and price charts.

The Big Lie Crypto Taught Us

Crypto culture trained us to believe:

“If you find the right coin, everything else solves itself.”

But after multiple cycles, one truth became obvious:

Narratives move markets before fundamentals do.

Coins don’t move because they’re good.

They move because attention shifts.

Once I understood that, my entire approach changed.

This behavior closely matches patterns explained by investor psychology in financial markets, where emotion often outweighs rational decision-making.

What Actually Drives Crypto Attention in 2026

Instead of watching price, I now watch signals.

Here are the 5 signals that consistently show up before retail hype hits.

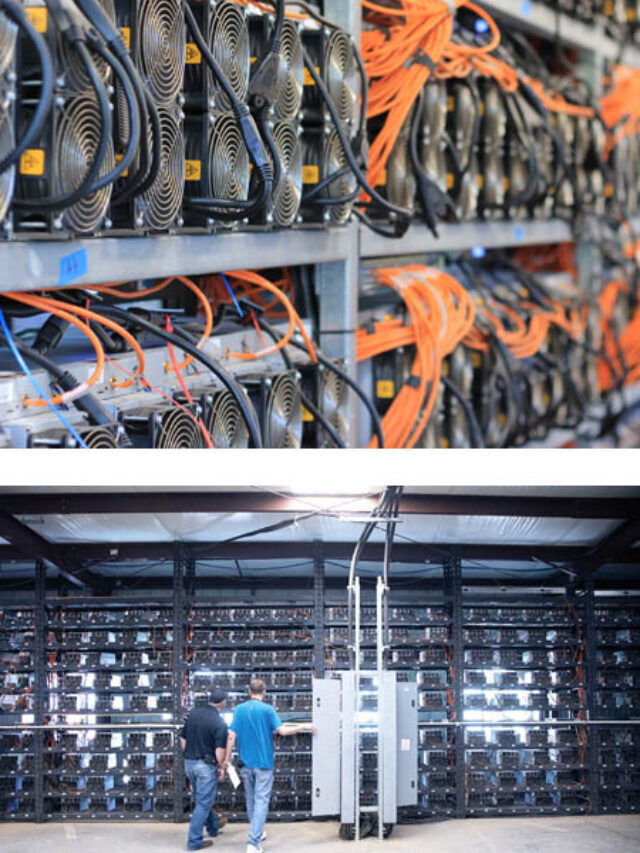

Infrastructure Quietly Expanding (Before Anyone Cares)

The most interesting crypto activity in 2026 isn’t loud.

It’s boring:

- Developer documentation updates

- Backend tooling launches

- Protocol upgrades no one tweets about

When I see builders shipping while prices stay flat, that’s a signal.

Hype comes later.

This is how Layer-2 ecosystems, oracle networks, and data protocols quietly gain strength — long before YouTube thumbnails appear.

When Crypto Stops Talking to Crypto People

One of the biggest green flags now?

When a crypto project stops marketing to crypto Twitter and starts appearing in:

- fintech discussions

- AI tooling conversations

- payments and infrastructure spaces

That usually means the project is trying to integrate, not pump.

And integration attracts capital slower — but sticks longer.

Read More : Why People Still Believe Crypto Will Change Their Life

Regulation Mentions Without Panic

This one surprised me.

In earlier cycles, regulation talk killed momentum.

In 2026, it does the opposite.

When projects:

- openly discuss compliance

- prepare for US frameworks

- work with institutions instead of fighting them

It signals long-term survival, not short-term hype.

Markets may not react instantly — but they remember.

Tokens People Use, Not Trade

The most overlooked question I ask now:

“What would happen if this token couldn’t be traded for a month?”

If the answer is nothing, it’s probably hype.

But if the token is:

- required for data access

- used for validation

- embedded into infrastructure

Then speculation becomes optional — not required.

Those are the tokens that survive boredom.

Communities That Don’t Promise Anything

This sounds counter-intuitive, but it works.

The loudest communities usually peak fastest.

The strongest ones:

- talk about tools, not price

- share documentation, not charts

- argue about design, not gains

When a community is more focused on building than convincing, it’s usually early.

Why This Matters for US Investors Right Now

The US crypto audience in 2026 is different.

People are:

- more cautious

- more regulation-aware

- less impressed by “10x” talk

Content that still screams explosive gains feels outdated.

What performs better now:

- honesty

- experience

- restraint

That’s why articles like this get shared — not bookmarked for later, but read fully.

The Shift That Changed Everything for Me

I stopped asking:

“Which crypto will explode next?”

And started asking:

“Which crypto would still matter if prices stayed flat for two years?”

That single question filtered out 90% of noise.

What remained wasn’t exciting —

but it was real.

Final Thoughts: Attention Is the Real Currency

In crypto, price follows attention.

But sustainable attention follows usefulness.

By 2026, the game isn’t about being early to a coin.

It’s about being early to a reason.

And reasons age better than hype.

Written by FinanceBeliever Editorial Team

Covering crypto culture, market psychology, and the human side of digital finance — beyond charts and noise.