Here is the summary of the topic

Introduction

- A brief overview of the global banking crisis

- Mention Credit Suisse, First Republic Bank, and Pacific Western Bank as examples

Credit Suisse

- Explanation of Credit Suisse’s involvement in the collapse of Greensill Capital and the Archegos Capital Management scandal

- Discussion of the losses incurred by Credit Suisse

- Implications of Credit Suisse’s situation for the banking industry

First Republic Bank

- Overview of First Republic Bank’s recent loss of over $212 million due to a single loan

- Lack of details regarding the client responsible for the loan

- Potential consequences for First Republic Bank

Pacific Western Bank

- Overview of Pacific Western Bank’s struggles in the wake of the pandemic

- Discussion of the bank’s reliance on commercial real estate

- Impact of the pandemic on Pacific Western Bank’s loan portfolio

Lessons for the Banking Industry

- Examination of the challenges facing the banking industry, including low-interest rates, increased competition from fintech companies, and the fallout from the pandemic

- Need for banks to diversify revenue streams, reduce risk-taking, and focus on sustainable growth.

- Call to action for the banking industry to adapt to the changing times.

Conclusion

- Recap of the issues facing the banking industry

- Reiteration the need for the banking industry to adapt and change

- Final thoughts on the future of the banking industry.

Here is the topic discussed briefly

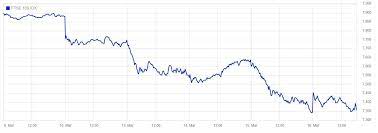

The global banking crisis has been a looming issue for some time now, and recent events indicate that it’s only worsening. Credit Suisse, First Republic Bank, and Pacific Western Bank are three examples that highlight this trend. This blog will discuss the problems each of these banks faces and what it means for the global banking industry.

Read More- How To Use Mobile Banking Directives Of National Bank Of Ethiopia?

Credit Suisse, a Swiss multinational investment bank and financial services company, is currently in hot water due to the collapse of Greensill Capital. Greensill was a financial services company specializing in supply-chain finance and was backed by Credit Suisse. However, when it was revealed that Greensill was using questionable accounting practices, Credit Suisse was left with billions of dollars in losses. The situation has been compounded by revelations that Credit Suisse was also involved in the Archegos Capital Management scandal, resulting in further losses.

First Republic Bank, a San Francisco-based bank that caters to high-net-worth individuals and businesses, is also facing issues. The bank recently revealed that it had lost over $212 million in a single loan to a single client. This client, who remains unnamed, defaulted on the loan, leading to First Republic Bank’s substantial losses.

Finally, Pacific Western Bank, a California-based commercial bank, is dealing with the fallout of the pandemic. The economic slowdown has hit the bank hard, resulting in a significant increase in loan-loss provisions. In addition, Pacific Western Bank’s loan portfolio is heavily skewed towards commercial real estate, which has been hit particularly hard by the pandemic.

These three examples demonstrate the scale and scope of the global banking crisis. The banking industry faces many challenges, including low-interest rates, increased competition from fintech companies, and fallout from the pandemic. These challenges have led to increased risk-taking by banks, which, in turn, has led to substantial losses.

So, what this means for the global banking industry? First, the industry needs to step back and re-evaluate its practices. The traditional banking model, focusing on lending and investments, may need to be revised in the current climate. Instead, banks must diversify their revenue streams, reduce risk-taking, and focus on sustainable growth.

Read More- 7 Simple Steps to Quickly and Securely Enroll In Online Banking

In conclusion, the global banking crisis is worsening, and recent events at Credit Suisse, First Republic Bank, and Pacific Western Bank highlight this trend. As a result, the industry needs to take a long, hard look at itself and make some changes if it wants to survive and thrive in the coming years. It’s time for the banking industry to adapt to the changing times and embrace a new business method.